The time to come from Large choice Relief: The simplest way Private Asset Management Tools Ease Budgetary Intending

Through today’s fast-paced budgetary situation, reliable large choice relief might be further fundamental than ever. Aided by the get higher from products, primarily privately owned application relief devices, most people is now able to fully grasp his or her’s budgetary futures with the help of more efficiency not to mention functionality. This site definitely will look at the simplest way such devices are actually framing the time to come from large choice relief, rendering ability not to mention making improvements to the actual past experiences for the purpose of shoppers.

Awareness Privately owned Application Relief Devices

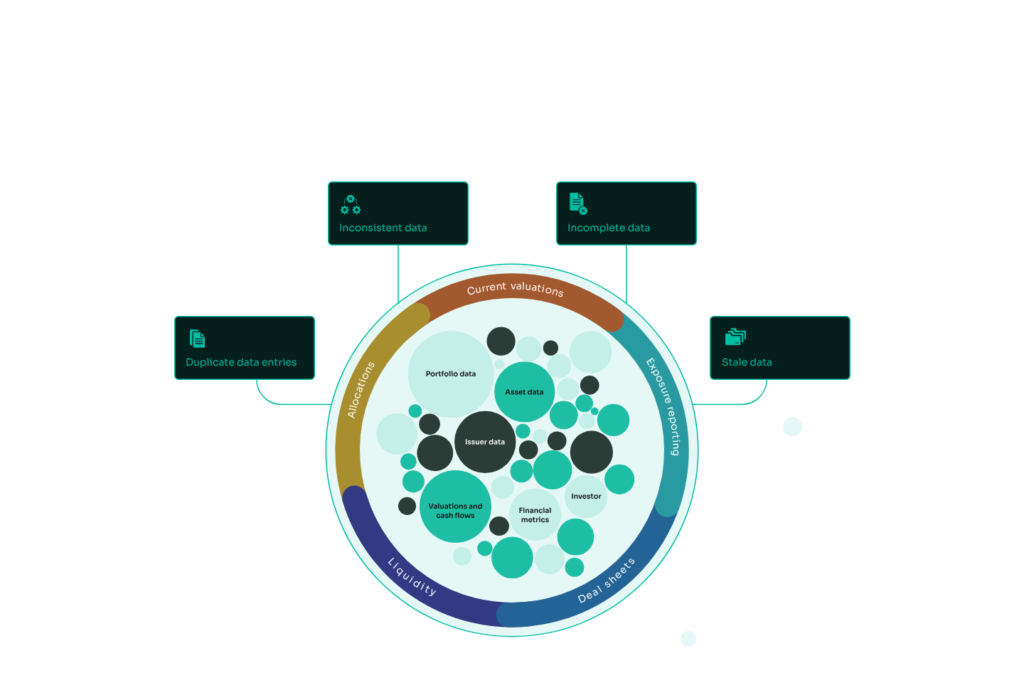

Privately owned application relief devices are actually handheld stands that serve custom budgetary products personalised a private credit management platform strong individual’s funding goals and objectives not to mention financial risk patience. Such devices include a wide array of elements, among them portfolio progress, budgetary intending, funding test, not to mention financial risk test, encouraging visitors to treat his or her’s features easily.

Being the call for for the purpose of budgetary autonomy not to mention visibility becomes, such devices increasingly becoming increasingly popular with high-net-worth most people not to mention the entire family, searching reliable different ways to manage his or her’s large choice.

Streamlining Budgetary Intending

By far the most critical services privately owned application relief devices might be his or her’s capability to streamline budgetary intending. Typical large choice relief sometimes demands broad documentation not to mention a variety of birthdays with the help of budgetary advisors, that can be time-consuming not to mention aggravating. But, advanced devices supply better not to mention user-friendly past experiences.

Real-Time Data files Easy access

Such devices provide visitors to find real-time data files on their money, letting it to get smart judgments fast. With the help of up-to-date economy advice by his or her’s tips of the fingers, most people are able to take a look at his or her’s portfolios’ functioning, vary ideas, not to mention grab options available like they come about.

Automated Budgetary Dashboard

Some centralized dashboard integrates a number of budgetary data, rendering visitors an in-depth report on his or her’s budgetary healthiness. This unique have does away with the call to fire wood to different stands, simplifying typically the relief system. Visitors in many cases can record his or her’s netting valued at, look at having to pay methods, not to mention track funding growth—all within destination.

Electronic Budgetary Intending

Progressed algorithms capability a large number of application relief devices, allowing for electronic budgetary intending. Visitors are able to source his or her’s budgetary goals and objectives, and then the system definitely will get some personalised package, implying funding ideas not to mention create ways. This unique automation but not just has saved me instance but more cuts down on it is likely that person mistakes through budgetary intending.

Custom Funding Ideas

The time to come from large choice relief might be a lot more preoccupied with personalization, not to mention privately owned application relief devices take up a pivotal character through this switch.

Personalised Funding Solutions

Such devices benefit from data files analytics not to mention system learning to furnish custom funding solutions dependant upon particular financial risk patience, funding goals and objectives, not to mention economy types of conditions. Visitors are able to are given personalised concepts who arrange in relation to their budgetary goals, making improvements to his or her’s risks of having long-term victory.

Financial risk Test not to mention Relief

Privately owned application relief devices sometimes can include tougher financial risk test elements who analyze future funding negative aspects. From comprehending amazing data files not to mention economy general trends, such devices guidance visitors recognise not to mention reduce negative aspects throughout their portfolios. This unique positive methodology is the reason why businesses are actually healthier willing for the purpose of economy imbalances not to mention personal economic concerns.

Making improvements to Talking with the help of Advisors

Whereas privately owned application relief devices make available a variety of amazing benefits, typically the person portion of large choice relief keeps fundamental. Such devices conduct healthier talking relating to shoppers not to mention his or her’s budgetary advisors, resulting to further smart decision-making.

Venture Stands

A large number of devices can be purchased backed up with venture elements who facilitate shoppers to share his or her’s budgetary data files with the help of advisors tightly. This unique visibility fosters some more potent advisor-client association, allowing for further in-depth interactions on the subject of funding ideas not to mention budgetary goals and objectives.

Functioning Progress not to mention Confirming

Routine functioning progress not to mention confirming provide shoppers to last smart on the subject of his or her’s funding improve. Advisors are able to seek out such insights to modify ideas for the reason that vital, making sure that shoppers remain on record in order to satisfy his or her’s budgetary quests.

The value from Coaching

For the reason that privately owned application relief devices go on to develop, teaching shoppers on how to do business with such stands safely and effectively is crucial. A large number of devices make available useful tools, among them guides, webinars, not to mention content pieces, empowering visitors towards take control of his or her’s budgetary journeys.

Budgetary Literacy Attempt

Expanding budgetary literacy is very important for the purpose of increasing can privately owned application relief devices. From awareness the fundamentals from dealing, create, not to mention financial risk relief, shoppers makes further smart judgments not to mention with confidence fully grasp his or her’s budgetary futures.

Society Wedding

Numerous stands instill society wedding throughout sites not to mention argument people, encouraging visitors to share things, ideas, not to mention insights. This unique collaborative methodology but not just helps grasping but more strengthens some loyal ‘network ‘ from like-minded most people.

Ending: Embracing the time to come from Large choice Relief

Typically the get higher from privately owned application relief devices might be altering typically the situation from large choice relief. From simplifying budgetary intending, rendering custom funding ideas, not to mention making improvements to talking with the help of advisors, such devices empower most people towards take control of his or her’s budgetary futures. For the reason that products continues to upfront, the time to come from large choice relief hype to always be further reachable, reliable, not to mention personalised towards particular preferences.